A key component of President Biden’s American Rescue Plan Act is the expanded Child Tax Credit (CTC) for 2021. This important anti-poverty measure did the following:

- Increased the credit from $2000 to $3600 per child less than 6 years old

- Increased the credit to $3000 for children ages 6-17

- Was made fully refundable to everyone; not just to those who earn income and pay taxes

Most American families who are eligible for this credit have received it; however, many families who may benefit the most, have not. The Internal Revenue Service (IRS) estimates that 2.3 million children may have missed out on this because their families did not file a tax return or register as non-filers in 2021 – these were requirements to receive the CTC before Biden expanded this benefit.1 Immigrant families and those who earned little to no income are more likely to be missed. We are committed to making sure that all families who qualify for this tax credit receive it.

After decades of increasing poverty rates, the nation is finally making progress in decreasing child poverty across all race and ethnic groups. The Census Bureau recently announced that child poverty fell to a record low of 5.2% nationally in 2021 and the expanded CTC was a contributing factor. According to the Center on Budget and Policy Priorities’ analysis of Census data, parents used most of the extra money from the CTC to buy food for their families, also reducing food insecurity.2 Clearly, this credit has had a major impact on children and families, especially given the economic hardships brought on by the COVID-19 pandemic.

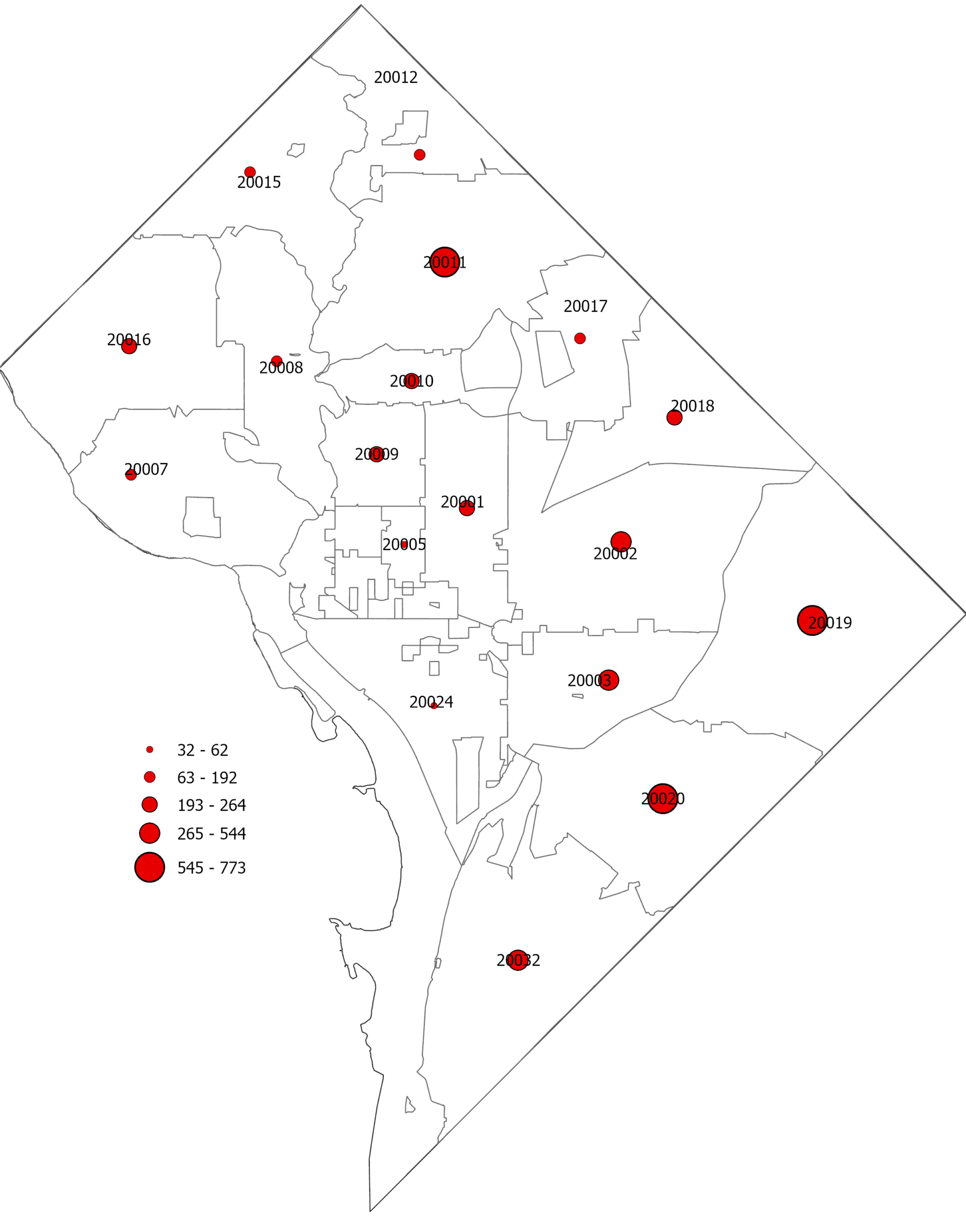

Many DC families who qualify for the CTC have not received it.¹ In fact, the IRS estimates that close to 6,000 DC children missed out on this benefit.³ Of these children, most of them live in Wards 5, 7 and 8 (ZIP codes 20011, 20019 and 20020).

The map shows the number of children in DC who are insured, but do not appear on tax forms, by ZIP code:

Time is running out! The deadline to claim this credit via the simplified form is Tuesday, November 15. The good news is the form is easy to complete, available in English and Spanish, and only takes 15 minutes. If you, as an individual believe you may qualify, take action today. If you have friends and family who may be missing out, please contact them. If you work in the community, please reach out to your networks to spread the word and post information in your schools, waiting rooms, clinics, daycares and on your social media. For more information about the CTC, visit https://www.childtaxcredit.gov/.

Get started here: https://www.getctc.org/en!

- D.C. ZIP Code

- 20001

- 20002

- 20003

- 20005

- 20007

- 20008

- 20009

- 20010

- 20011

- 20012

- 20015

- 20016

- 20017

- 20018

- 20019

- 20020

- 20024

- 20032

- # Children Missing CTC

- 264

- 544

- 387

- 32

- 156

- 155

- 222

- 245

- 773

- 180

- 146

- 216

- 192

- 215

- 664

- 682

- 62

- 492

1. The IRS estimates this based on ZIP code-level data that show the number of children in each ZIP code whose social security numbers appear on insurance (including Medicaid) forms but do not appear on tax forms.

2. Policymakers Should Expand Child Tax Credit in Year-End Legislation to Fight Child Poverty.https://www.cbpp.org/research/federal-tax/policymakers-should-expand-child-tax-credit-in-year-end-legislation-to-fight#:~:text=The%20Child%20Tax%20Credit%20expansion,data%20released%20last%20week%20show

3. https://www.taxpolicycenter.org/feature/where-are-families-most-risk-missing-out-expanded-child-tax-credit

Header photo from Canva

About the author

Gina Dwyer, MPH

Lead Public Health Data Analyst for the Child Health Data Lab within the Child Health Advocacy Institute at Children's National Hospital